Earn Bank-Beating

Interest with Your Crypto

Allocate your crypto assets to the Savings Pool to use and earn a return! Interest is paid daily and compounded over time, so you can lean back, relax and watch your crypto assets grow. Withdraw anytime, with no lock-in period, no waiting and no fees.

How to Start Earning Crypto

the Simple way

Deposit your Crypto

Transfer your crypto assets to your Vigiler custody account. The moment your deposit arrives, you can choose between different services, such as the Savings Pool. Just one click and your deposits start earning!

Choose How You Earn

Asset allocations or withdrawals are executed instantly. You don’t have to choose between quotes. Everything is automatic!

Watch Your Crypto Grow

At the end of each day, your interest is credited to your Wallet account. Your interest is compounded when you add it to the Savings Pool, which means that your newly earned interest will also earn interest. All you have to do is watch your crypto grow!

Don’t Pay the Price of Idleness

Is your crypto sitting idle on your crypto exchange wallet? Are you keeping your savings on a traditional bank account? That means you’re losing money you could earn with Vigiler.

No Small Print. Just Honesty

We pride ourselves in being honest and doing what’s best for our clients. That is why we don’t hide our terms & conditions in sub-pages and small prints. You earn what you see with Inlock.

- No fees or charges

- No withdrawal limits

- You can withdraw at any time, up to the limit of the freely available asset in the pool.

- No minimum or maximum deposit amount

- No earning limits or variable interest

- Already allocated assets and their returns take priority! New assets can only be allocated if the allocation exceeds 10%.

We Go & Grow

Further Together

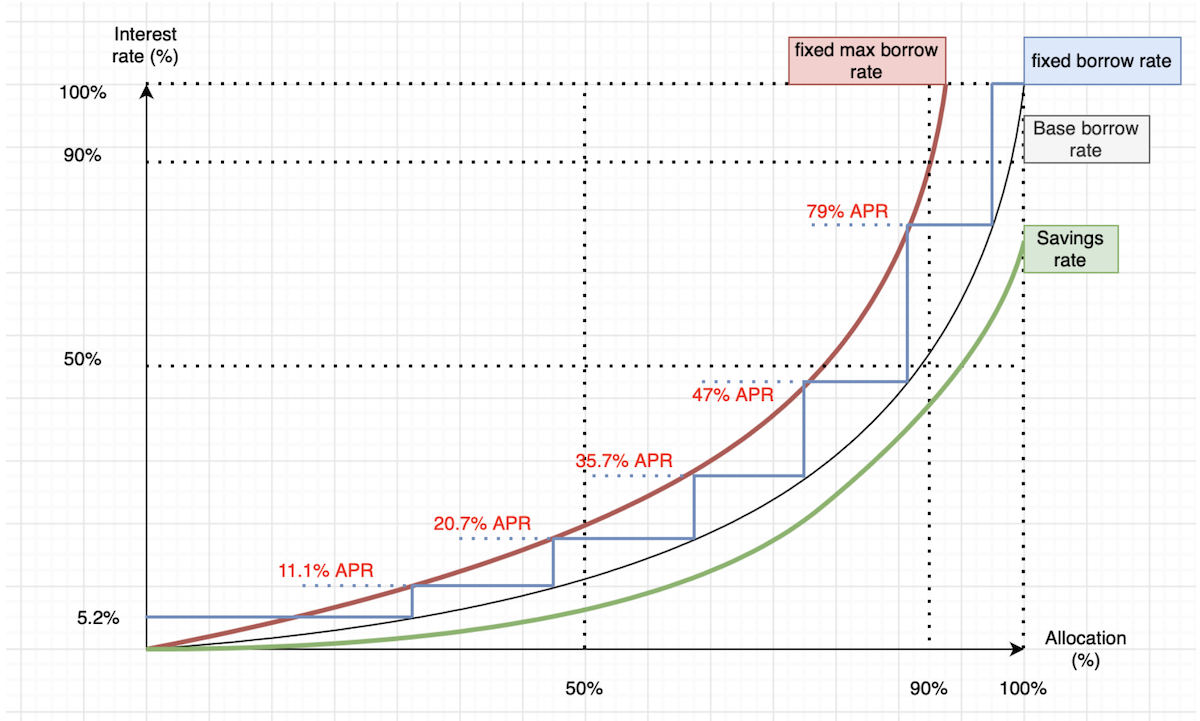

The purpose of the Savings Pool is to provide liquidity for additional services on the platform. The system may pay interest on the assets stored in the Savings Pool in proportion to the allocations. Allocation shows the proportion of liquidity from a given coin or token that is actively used in other services. The higher the allocation ratio, the higher the interest the client receives on the assets in the pool. The platform may limit the number of new assets can be placed in the pool if the pool allocation for a particular coin or token is persistently low. Clients can initiate an asset withdrawal from the Savings Pool at any time, but this will only be executed if the desired amount of the coin or token is available in unallocated form. The platform applies a so-called “provisioned interest rate” principle, whereby interest is paid daily, backed by the interest earned over the previous 100 days. At maximum allocation, interest rates of up to 80% per annum are available.

The platform uses an automatic interest rate setting and correction model. The aim is to provide predictable and favourable conditions for using the platform’s services.

Interpreting the figure:

- Base borrow rate: the thin black line shows the interest rate at which thecounterparty can access the liquidity source for all short-term floating rate allocations (e.g. dual swaps). Interest is calculated on an hourly basis, each hour based on the current allocation rate.

- Fixed borrowing rate: the blue stepped line indicates the interest rate for long-term (10 days to 360 days) loans. The interest rate does not change during the term unless the client uses the “instant credit line” option. The interest rate on a long-term loan can be 5.2%, 11.1%, 20.7%, 35.7%, 58.3%, 90.6% and 100%

- Savings rate: the chart shows the annual interest rate at which those who provide liquidity to the Savings Pool receive a return on their allocation. The interest is credited at the end of the day based on the interest income generated on that day.

- Detailed rules:

- if the Savings Rate for a given coin or token is less than or equal to 0.1%, no interest will be paid on that coin on that day

- if the Allocation (%) for a given coin or token is less than 10%, no new crypto asset may be placed in that pool

- to avoid highly volatile daily interest payments, the platform aims to spread the interest payment proportionally over the next 100 days. In practice, the platform reserves the right to fine-tune the duration of the distribution to maintain optimal performance.

Service Fees and their Reallocation

Wallet, Savings Pool, and Collateral Option products, including deposit and internal transfer services, are free to use. With the Wallet product, there is a fee for withdrawals depending on the transaction fees of the respective network. The platform also offers the possibility to transfer crypto assets through several alternative networks, some of which may be free of charge.

Savings Pool interest markup: the chart in the Loan and Savings Interest annex shows the extent to which the platform earns platform revenue from the interest markup. This represents a platform fee of between 1% and 30% depending on the allocation size and the related product (variable or fixed rate product). This fee is also part of the reduction of the compensation balance, as follows:

- 50% of the platform fee due on interest payments will be payable as compensation to the client from whom the interest is derived. As a result, the borrower can reduce the actual interest payable on the loan by up to 10-15%.

- 50% of the platform fee on interest payments is available to customers who still have a compensatory balance in the Savings Pool allocation

Calculation aid:

- Savings benchmark interest rate: rate% = 1.0997**(0.45 * allocation%) – 1.047. If result < 0.1, then rate% = 0

- Base loan interest reference: loan% = 1.5 * (1.0967**(0.457 * allocation%) – 1.047

- Suppose the annualised rate of return (APR) of the interest amount paid is greaterthan or equal to the annualised rate of return of the savings reference. In that case,100% of the interest is paid as interest, so in this case, there is no platform fee.

- Suppose the annualised rate of return (APR) of the interest paid is lower than the annualised rate of return of the savings reference rate. In that case, the amount equal to the savings reference rate is charged as Savings Pool interest and the remainder as a platform fee. The platform fee is refunded to the interest payer and the customers providing funds to the Savings Pool in the proportions described above